Choosing the Perfect Prepaid Voucher Provider

In today’s rapidly evolving digital landscape, prepaid vouchers have become a versatile and convenient transaction method. Offering many benefits, from enhanced security to budget management, they have gained significant traction among businesses and consumers alike.

However, with many prepaid voucher providers vying for attention, selecting the optimal one for your needs can be challenging. This article serves as your comprehensive guide to navigating this decision-making process, ensuring that you choose the right prepaid voucher provider that aligns seamlessly with your requirements.

Understanding Your Needs

Before delving into the realm of prepaid voucher providers, it is paramount to have a clear understanding of your needs and objectives. Are you a business seeking a secure mode of payment for your customers? Or a consumer aiming to manage personal expenses more efficiently? Identifying your primary purpose will lay the foundation for the subsequent steps in this selection process.

Security Measures

Security stands as a paramount concern when dealing with any financial transaction. Ensuring that the prepaid voucher provider employs robust security measures is non-negotiable. Look for providers that offer features such as PIN protection, encryption, and two-factor authentication. A reputable provider will have a track record of safeguarding user data and preventing unauthorized access to funds. For example, a voucher provider called Flexepin offers a 3D secure authentication system in addition to other security measures. This system requires users to enter their PIN when purchasing, adding an extra protection layer.

Evaluating Voucher Options

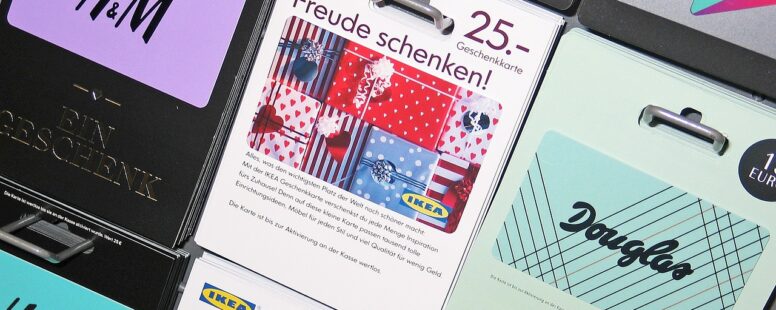

Prepaid vouchers come in various forms, each tailored to specific use cases. Gift cards, mobile recharge vouchers, and general-purpose prepaid cards are among the common options. Assess your target audience and discern which type of prepaid voucher aligns with their preferences and your intended usage. For instance, if you run an e-commerce platform, offering gift card vouchers might be an effective strategy to enhance customer engagement and retention.

Transparent Fee Structure

Carefully scrutinize the fee structure of potential prepaid voucher providers. Some providers may impose hidden charges or complex fee systems that can erode the value of your prepaid vouchers. Opt for providers with a transparent fee structure that clearly outlines any fees associated with purchasing, using, or maintaining the prepaid vouchers. This transparency will facilitate accurate budgeting and prevent any unpleasant surprises down the line.

Customer Support Quality

Responsive and effective customer support can make or break your experience with a prepaid voucher provider. A provider that offers prompt assistance and clear resolutions to any issues that may arise can save you valuable time and alleviate potential frustrations. Before deciding, research reviews and testimonials to gauge the provider’s customer support quality and responsiveness. Selecting the right prepaid voucher provider necessitates meticulously evaluating your needs, available options, security measures, network acceptance, fee structure, and customer support. By undertaking this comprehensive assessment, you can confidently opt for a provider that seamlessly aligns with your objectives, be it enhancing customer engagement for your business or managing personal finances more effectively as a consumer. In a digital era where financial transactions are becoming increasingly diverse, making an informed decision regarding prepaid voucher providers is a strategic move that can yield substantial dividends.